Hitting the million-dollar mark in a savings account may be an elusive dream for many. But contrary to popular belief, most millionaires aren’t celebrities and musicians, but average people who are committed to a savings plan. That could be you, nanny!

Time plays a significant role in your savings plan. Starting early can earn you so much more, as your money gains interest over time. Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Through the power of compounding, your money works for you. So, don’t let another year go by without a plan!

Unlike with traditional workplaces, retirement for you, dear nannies, is especially important, as you may not be given access to 401(k) plans or the typical retirement benefits that accompany a corporate job. Worry not! There are ways you can take ownership of your retirement, be intentional in planning for it, and even start as early as now to hit that million-dollar mark!

Setting Up an Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is a long-term retirement savings account that allows anyone with an earned income to save money for future use. One good thing about setting up an IRA is that it gives you special tax advantages–either a tax deduction now with tax-deferred growth, or tax-free growth and withdrawals in retirement. It’s specifically designed for employees who do not have access to workplace retirement accounts that are available through employers, such as a 401(k). Since it’s a long-term investment, taking out the funds early will lessen your retirement assets.

Some families may choose to make a contribution to a nanny’s IRA account as a part of the nanny’s income, as a benefit, or as part of an annual bonus. These contributions should be reported to the IRS by the family as a part of your income.

Why is the Roth IRA a highly preferred retirement plan?

While there are other retirement options available, one thing to consider in opening an IRA is taxes. With a Roth IRA, your money grows tax-free! Think of it this way: when you open your Roth IRA, the contribution you put in there is after-tax money. That’s why you won’t pay any taxes when you take out your money on or after the date you turn 59 ½ because you’ve already paid for it!

You can also just leave your money and let it grow as long as you’re alive with no RMDs (required minimum distribution) or the amount you are required to withdraw from your account each year. Unlike in a traditional IRA, where you are required to begin taking distributions at the age of 72. You can also choose beneficiaries who can inherit your Roth IRA. Your investment in your Roth IRA also grows through compounding, so your wealth continues to grow even when you can’t make a contribution.

How does the Roth IRA work?

There are some things you must consider when setting up a Roth IRA.

First there is a cap to how much you can contribute. For 2023, the total contributions you make to all of your traditional IRAs and Roth IRAs can’t be more than $6,500 ($7,500 if you’re age 50 or older). Unlike a traditional IRA where there are no annual income limits and anyone can contribute, Roth IRAs have annual income limits. In 2023, you could contribute up to the maximum amount if your gross income is less than $138,000 if single or filing separately from a spouse and $218,000 if married and filing taxes jointly. If your income is higher than the said amounts, you can have a reduced amount of contributions or none at all.

Since this is a long-term investment, you want to let your money gain interest and to only take it out in your retirement. Withdrawing from your Roth IRA before you turn 59 ½ may incur you a potential 10% early withdrawal penalty in your earnings.

How does your money grow over time?

Your return on investment (ROI) is actually largely dependent on the type of investments you select considering your risk appetite. But historically, investments held in Roth IRAs have an average annual return between 7% and 12%. Of course, a low-risk investment will earn you a lower return.

Compound interest is also the key to growing your wealth. Compound interest is the interest added to your contributions referred to as the principal amount and to the accumulated interest your investment gains over time. Your Roth IRA holds your investment that earns interest and dividends over the years.

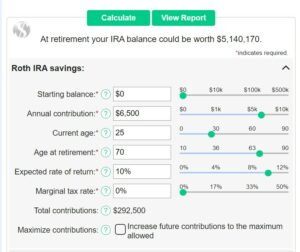

For example, let’s say you start contributing to a Roth IRA at age 25. You contribute $6500 annually (the maximum contribution limit for 2023) until you reach age 70. Now, let’s say that your Roth IRA investment earns interest at a 10% compounded rate each year. You could possibly earn $5,140,170!

*Sample computation from The Annuity Expert Annuity & Insurance Agency

The sample above is at a fixed annual return of 10%. However this percentage can change depending on market performance. But even if your return is only half as much (3.5-6%), you’ll still end up with around $700,000-$1,400,000. You can try using this Roth IRA calculator to see how much your contributions could be worth at your retirement.

It may not always have steady returns but the key takeaway here is that compound interest helps your money grow at an accelerated rate. It also means that you’ll have the chance to save more for your retirement if you start early! You can even reach over a million worth of savings when you start at age 25 and just let your money grow until retirement!

How to start your Roth IRA

Now that you know how Roth IRAs work and how your money could possibly grow over time, now’s the time to get started! But how do you start one? Setting up your Roth IRA is like opening a savings account. Here are the simple steps.

1. Make sure you’re eligible.

Once you think that you’re financially ready to save up for your retirement plans, you can start planning your Roth IRA. There is no minimum contribution to open a Roth IRA according to IRS rules. However, this type of IRA is not for everyone. Although there are no age restrictions, you are only eligible to open a Roth IRA if you are earning an income that meets the annual income requirements that change yearly.

To set up an account quickly and easily, Westside Nannies recommends Vanguard.com, as it’s simple to use and understand.

2. Choose where you want to invest wisely.

One of the many perks of opening a Roth IRA is knowing that it’s an investment vehicle controlled by you and not your employer. So you have options, such as investments in mutual funds, stocks, bonds, exchange-traded funds (ETFs), certificates of deposit (CDs), money market funds, and even cryptocurrency. Ramsey Solutions, however, recommends mutual funds because they have the highest potential for helping you build wealth over time—especially with the tax benefits that come with a Roth IRA.

Once you sign up, think of your Roth IRA as a shopping basket; it’s not an investment in itself but it holds your investment. Choosing where to invest can be challenging because there are many options to choose from, so make sure you research your options before investing. You can DIY but you can also always consult with a financial advisor or your bank about it. Always think long-term!

3. Fill out necessary paperwork.

You can choose to sign up for a Roth IRA on your own or you can do it with a pro. Either way, get this information ready:

Your driver’s license or other government-issued form of photo identification

Your Social Security number

Your bank’s routing number and your checking or savings account number

Your employer’s name and address (optional)

In nominating your beneficiary, have their name, Social Security number, and date of birth on hand, too.

4. Set up your contributions.

The last step is to set up your contributions, and an easy way to do it is by automating your investing. You can set an automatic deposit of funds to your Roth IRA from your payroll, withdrawals, or direct deposits. For example, you can set up a monthly automatic transfer of $500 to your Roth IRA so that in a year, you’ll have invested $6000. Although it may take extra paperwork, automating your contributions will help you be more disciplined and consistent with saving up. Just remember to check on your contributions from time to time so that you can track the progress and make necessary changes if need be.

Start Saving Today

The best preparation for tomorrow is to plan today. It’s never too late to start saving for your retirement. Aside from setting up an account for your retirement plan, there are other ways to start thinking about your future, too. You can track your cash flow and see where you can reduce expenses, or try creating a budget if that works for you. Getting a raise? Good for you! Consider investing the difference. When it comes to saving, delayed gratification is always worth it!

While it may be easy to put off saving for another time, it’s important to recognize how saving up today can assure you a comfortable life down the road. The younger you start, the better off your future self will be, and the sooner you do it, the less you’ll worry about your finances in the future. Start now and be your own millionaire in the future!

Recent Comments